Friday, 15 February 2013

Monday, 21 January 2013

Tips to create a household budget

Where does your monthly salary go? Do you allocate a

certain amount to be spent on the house, or is it a case of buying

things as you need? Did you know that there are huge savings to be had

from maintaining a budget, and not just in terms of cost?

What is household budget management? Managing a budget for your household is more than just keeping track of all the expenses for the month. It is a chart of how much income there is, how much will be spent, and what can be saved. The idea of the budget is to broadly plan for living within your means. A budget ensures that bills are paid on time, household debts are cleared and savings goals are set and achieved.

A really simple way to do this is to label different envelopes with the heads of all the recurring expenses of the month (such as rent, electricity, help, car EMI, etc.). You then know exactly what is going where, and if there is any left over, it can either be carried over to the next month, or set aside as a saving.

You could also project your monthly income and create accounts from which to debit or credit money as bills are paid and income is received.

Where do you start?

Begin by making a plan

Create an inventory of needs and wants, from the biggest to the smallest. Learn to differentiate between needs and wants; those things that are essential to living, and those that make your life better. Categorise between non-negotiables (such as food, rent, clothing, education, transportation, and insurance) and everything else. Or further divide into what is necessary, what is adaptable, and what is expendable.

Select an appropriate budget format

You can download these for free from the Net, or create one of your own. You need to ensure your spreadsheet works on a monthly cost basis, so all income and expenses should be multiplied or divided to fit this calculation. A weekly expense should be multiplied by 52 (weeks in the year) then divided by 12 (months of the year) to get a monthly equivalent figure. A quarterly bill should be divided by 3 to get a monthly amount etc.

Track your expenditure for a month to establish your spending pattern.

This also allows you to prune out those things that can be classified clearly as 'frills'.

Become a conscious spender

Now that you have an idea of where your money goes, you have to actually keep that in your mind while you spend. And set aside time to review your finances and expenditure on a weekly basis.

Go local

The supermarket may contain everything under one roof, but if you spend a little time comparing prices, you will find that local shops carry items of the same, or better quality, and at better prices. You're also assured of freshness if you go to the market.

Prepare for the unexpected

Car repairs, medical costs, weddings and birthdays, appliance maintenance, emergency travel, all qualify as additional expenditure, which you can actually plan for with the help of your spreadsheet, now that your finances are clearly laid out before you.

Reassess the budget after one month, making any adjustments that are necessary. Assess again after three months.

Making and maintaining a good household budget: Tips

Share responsibility

If you have a family, then it's very important that they know and understand how income is distributed over the month, and what it is you are working towards. You can even ask your children, if they are old enough, to contribute to the budget. You will be surprised at the innovative suggestions you will receive. Most importantly, you have buy-in.

Set targets

Save money on a monthly basis to achieve your target, whether it's a high end mobile phone, or a holiday. Don't succumb to instant credit card purchases or EMI payments on the smaller stuff. In fact, put away your cards and stick to cash.

Think out of the box

Emergencies are natural, and you will find yourself strapped for cash at times. The point is not to panic, but figure out a way in which you can spend less, save more, yet continue to live in the manner to which you are accustomed.

Review what you want

Differentiate between what is meaningful, and simply 'keeping up with the Kapoors'. Continue to do this often, because your desires will change, as you grow.

Be flexible

A budget is not meant to tie you down; rather, it gives you defined economic freedom, not financial restriction.

A good budget allows you control over your money, helps you enjoy rather than worry over it, makes spending more purposeful, and protects you from financial problems.

When you face steep interest rate hikes…!

In a rising interest rate scenario, times can be tough

for an existing borrower who is a couple of years into his tenure.

Ofcourse his monthly budget may not be affected in the short term, as

often banks increase the loan tenure in most instances. However,

increase in tenure would mean more interest outgo and if hikes happen

repeatedly the borrower will take even more time to close out an already

long term loan.

In such circumstances to either decrease his EMI burden or shorten

the loan tenure - as the case maybe he can try to discuss the situation

with the bank to arrive at a mutually beneficial solution. Though banks

or HFCs do not offer the option of negotiating interest rates half way

through one's loan tenure, some banks and housing finance companies do

consider a request from a borrower who has a good repayment track

record.On the basis of such a request, sometimes a loan conversion scheme could be worked out by the bank where the bank can shift an existing borrower to a new loan rate that a new borrower can lay claim to! In any case banks are expected to be involved in such an exercise when the base rate regime was introduced, where the old borrower can request to shift to the base rate system of interest rates.

Let us consider an example of how this works: Manoj took a loan from a housing finance company in November, 2008. After factoring in all his hikes he is currently paying a loan interest rate of 14% on his current outstanding loan amount. He approaches his housing finance company in an effort to negotiate his home loan interest rate as he finds that the new borrower is able to take up a loan at a much lesser interest rate than he is currently paying. On the basis of the good repayment track record the bank agrees to consider his request especially since he would always have the option of a loan transfer to a different bank.

However, to avail a new interest rate he would need to pay an upfront amount as a loan conversion fee. Banks usually charge a percentage of your outstanding principal amount as the conversion fee. The minimum percentage of your outstanding principal amount that is usually charged as fee is 0.5% -1%. The higher the spread between the new interest rate and the old interest rate, the higher the conversion fee that needs to be paid to the bank.

In case of a significant difference in spread, banks also calculate it in the following manner - By charging the consumer one half of the spread percentage of the outstanding principal amount.

Let us understand how much Manoj paid as loan conversion fee:

He took a loan of 30L on November 1, 2008 for a loan tenure of 20 years at an interest rate of 11.75%. His current interest rate is at 14% and outstanding loan amount is Rs.28.9 Lac.

The new interest rate he converted to in August 2011, will be 11%. The difference in spread between the two interest rates is 3%.

The percentage at which his loan conversion fee will be calculated on his current outstanding loan amount is ½ of 3% which is 1.5%.

Loan conversion fee =1.5% of 28.9 Lac = Rs.43,350.

If you do this periodically, you will be able to bring down your loan tenure considerably as the reverse happens (Increase in interest rate, will lead to increase in tenure, while if you move to a lower interest rate your tenure will decrease with the EMI being constant - i.e. same as when you started your loan). Of course you need to factor in the conversion fee and figure if it will still be beneficial. Chances are it will prove beneficial, helping you close out your loan earlier than planned.

Another way to do this conventionally is of course prepay your loan amount. Banks may have a clause stating you should not prepay immediately after you convert a loan. This may vary anywhere between 3- 6 months depending on the bank.

However, a combination of prepayment and conversion can yield good results. If your bank is not amiable to a loan conversion you should try prepaying in small amounts regularly instead. This is a more conventional and viable manner of closing out a loan in good time as well. Most banks offer prepayment rather than loan conversion.

Loan against shares: What should you know?

With consumer spending on rise and loans getting

expensive, individuals are finding new ways to fulfill their money

requirements. Providing Loans against Gold etc. is one more way in which

borrowers are able to procure loans from banks. Yet another way to

procure a loan is through LAS (loan against security). A loan against

shares would fall under this category. This option is not known to many

borrowers as banks do not advertise this often. The loan is granted when

you pledge your shares to the bank. More and more banks are offering

this option now and also expanding the financial assets that can be used

as for a LAS option.

How does this work?You cannot get a loan against all shares. Banks usually define the shares of the companies which can be pledged against the loan. These shares are very liquid, from high quality companies, and highly valued securities. The amount depends on valuation of shares, margin allowed by the bank, and your past credit history. The amount of loan is about 50% to 70% of the value of the shares pledged with the bank. Hence if your stock portfolio for these shares is 10 lakhs, you can get a loan of 5 lakhs to 7 lakhs against the stock portfolio. This again depends on the liquidity of the stocks in your portfolio.

You can pledge your shares with the bank, which will issue a current account. You can withdraw money from this account. The advantage of loan against shares is that you will be charged interest only on the amount you withdraw from the account and for the span of time the fund is utilized. The other advantage is that you require no personal guarantor for loan against shares.

Banks keep changing the shares against which loans can be taken. This happens at regular intervals. This is done to ensure the stability and liquidity of shares which can be pledged.

If you have shares in the physical form, most of the banks require that you convert them into dematerialized form and then only you can apply for a loan. Dematerializing physical shares is not difficult. Few banks may provide loan against shares in physical form too. However, the interest rate will be higher and also the loan amount as a percentage of the value of the share will be lower.

When should you go for it?

You should opt for loan against shares only when you need instant liquidity and you are sure to pay it back in few months. If you have any doubt on your repayment capability, try other sources.

The interest rate on loan against share depends on the prevailing rate in the market. You should compare the interest rate for loan against shares with other options such as a personal loan or need specific loan. If you find a cheaper option, go for that.

Many borrowers take loan against shares to invest it back in shares. Don't do this. Taking a loan to buy shares is a financially harmful habit. In fact many banks attach the clause that you cannot use it for buying shares.

Important points to keep in mind

Getting a loan against share is hassle free and the borrower is mostly free to spend the money in a manner he or she wishes to. This comes with no strings attached. You should have good and valued shares in your portfolio to get a loan against it. However, you must keep some factors in mind when you opt for this.

The minimum amount of a loan against shares is 1 lakh while the maximum amount is 20 lakhs. You can get the loan for a year and renew it in future. The tenure may vary with individual banks. The maximum amount in the case of physical shares is 10 lakhs.

Don't be tempted to borrow just because you have a good portfolio. You have built this portfolio over a period of time with due diligence. Unless absolutely necessary, don't pledge your shares to obtain a loan. If you do pledge to get a loan against the stock portfolio, make sure that you pay it back at the first opportunity.

Look at the various charges such as processing fees, one-time fee, renewal charges, Government levies, and service taxes. Usually there is no pre-payment penalty but it is advisable to ensure this with the bank. These charges may make the actual cost of loan higher than the interest rate charged.

Shares are valued every week to see the maximum limit of loan available to you. As long as the market is bullish, you will have no problem. In fact if the share prices go up, the banks will be able to give you a higher amount of loan. However, when the value of your portfolio falls, banks ask you to pay the difference using cash or by pledging more shares. This could be potentially dangerous if you do not have any cash available with you or any more shares. Banks may sell your stocks to recover the loan, if circumstances demand so.

The dividends, bonuses, or any benefit on the pledged shares will accrue to you.

On loan against other financial assets

Banks also provide loan against other financial assets such as mutual funds, insurance, bonds, fixed maturity plans, exchange traded funds, and Government securities. The total loan value against the pledged assets varies with individual cases. The value is higher, almost 80% of the asset value, for Government securities as these are risk free assets.

How can you cash in on inflation!

"Inflation" is the one dreaded word that can shake the

confidence of economists, investment bankers, policy makers and even the

government! Well, the harsh reality is that if the economy is growing

inflation will definitely raise its head to haunt you. Let's try to

explore why it is such a dreaded word and is there any hidden

opportunity for an investor to generate profit out of this?

Inflation is a state where there is steady (at times not so steady)

increase in price of goods and services. If there is too much money

rolling in the system it will lead to inflation as people will have more

money, which makes them willing to pay more for the same amount of

goods or services.Effects of Inflation on the market

Increasing inflation affects each and every sector of economy either directly or indirectly. The best buddies of inflation are rising interest rate, crashing stock markets, unemployment, rising bond yield and of course stress, which makes it appear on everybody's watch list.

Market Behaviour —

Inflation numbers are closely watched by analysts and investors. If there is slow and steady growth in inflation stock market behaves positively as inflation is considered a necessary evil. If the number is too high then we always see a knee jerk reaction in the negative direction.

Interest Rate cycle —

The prime reason for inflation is too much money in the system. Hence to curb it, policy makers increase interest rates so that liquidity is sucked out of the system. But as the interest rate rises, so does the cost of capital. Increasing cost of capital hampers the earning potential of companies leading to decreasing confidence of investors, resulting in stock market fall. Once the stock market falls people start running towards safer options like investment in government securities. At this point excess money seems to be resting in peace and the interest rate starts to decline and the whole cycle starts again!

Effect of inflation on investment decisions

So should you be bothered about inflation and alter your investment decisions based on it. If majority of your investment is in fixed income securities or in bank deposits then the answer is YES. Returns from fixed income securities are quite closer to inflation rates and hence you do not gain much in long run. The situation is worse if you sit on pure cash as your purchasing power is dwindling day by day.

If we cannot avoid inflation, let's figure out how to extract the most out of it. Two options which will provide a shield against eroding nature of inflation are the following.

Investment in stock market —

Generally every good company in the long run generates earnings, which is above inflation rate. Companies have the option of increasing prices of its products to enhance earnings and this pricing power acts as a weapon to fight inflation. As a smart investor, one should look for companies which can utilise this pricing power in times of persistent inflation.

Commodity prices are quite reactive to inflation and adjustments in prices are very fast so one should not ignore companies which deal in commodities. In an inflationary environment, most of the time we witness market crashes. One should use this opportunity to enter the stock market to reap better returns in future.

Investment in real estate —

In an inflationary environment, investment in home and land is always a safer option. Generally the price of a house and land increases with time and rate of appreciation is higher, as land is a limited resource.

Inflation Indexed Bonds —

RBI is also exploring the possibility to bring out inflation indexed bonds. The return on these bonds will be a little above the rate of inflation. When this is launched, inflation indexed bond could be a very good option for risk averse investors.

Final Words

As it's clear that we cannot avoid inflation let's make some smart investment choices to cope with it better. An interesting aspect is that inflation at times provides you an opportunity to buy some good stocks at cheaper prices. Just remember to be vigilant and be on the look out for opportunities.

Group Buying: A better way to buy your dream home?

Utopia Builders is a real estate company. The company

has just built a housing complex comprising of 55 flats. Since the real

estate market is down, Utopia could not sell all the flats and is left

with 25 flats still up for sale! Utopia is ready to give heavy discounts

if someone can buy in bulk, say 5 flats. Quite a few builders are in a

similar situation as Utopia. In spite of the heavy discount for a bulk

purchase offer, there were no takers as why would anyone want to

purchase 5 flats in one go?

Ramesh, Shan, and Sayeed are software engineers at Pune, Mumbai, and

Bangalore respectively. They know that the market is down and want to

make the most of this situation to buy a home. However, they are not

able to find a good property deal with attractive discounts in such a

subdued market.How can Utopia Builders and potential home buyers like Ramesh, Sayeed, and Shan get in touch with each other? It seems obvious that if these potential buyers and Utopia Builders got together, a mutually beneficial arrangement can be worked out!

Group Buying — a new trend in real estate buying

This is where the group buying concept comes into the picture. Since the last few years, group buying has been touted as a viable option for home buyers looking forward to get attractive discounts.

Here is how it works. Potential home buyers connect with one another through a common platform, usually provided by a third party or a group buying company (referred to as company hence forth), and form a group. The company then goes to the builder with a couple of orders and negotiates for possible discounts. The builder, sensing a good opportunity to sell a number of his properties, agrees to the discount. Typically, there is negotiation on discount but the discount is higher than what is offered in individual cases.

There are exclusive platforms such as http://www.groupbookings.in/, dedicated to group buying of homes, which help individuals to sort themselves out into like-minded groups, who are interested in bulk purchases of certain properties. Once a group is formed, the company negotiates with the builder on the group's behalf to get better discounts.

Compelling proposition for property developers

One of the reasons for the popularity of group buying is the advantage it offers to builders. Usually down payment in group buying is higher and hence developers who are just starting to build the complex get much needed cash. In the era of high interest rates and uncertain stock market, the higher down payment comes as a blessing for cash strapped developers.

Moreover, developers get a readymade market to sell their properties in bulk without spending anything in customer acquisition and marketing. This reduces their cost of selling. This savings can be passed to the home buyers in the form of extra discount.

Group buying also helps developers sell the properties faster and focus on the next venture.

Advantages of Group Buying for Home Buyers

The typical home buyer is in constant search for a better deal. As individuals, home buyers cannot negotiate for a better deal since it will not make economic sense for developers. The transaction cost with each individual will be high for developers. Also, an individual home buyer will not have bargaining power in a market dominated by real estate developers. By coming together and forming a group, the individual buyers can increase their bargaining power and hence will be able to bag a better deal!

For example, suppose Xanadu developers' prices 2 BHK apartments in its residential complex at 2800 per square feet. The company can negotiate the price and bring it down to 2300 to 2700 per square feet for group buying of apartments. This discount will be much more than what an individual home buyer can negotiate with the builder.

Typically, the company which negotiates on behalf of the home buyers will probably be able to get a 4% to 10% discount on the price of the property. This means if the price of your dream home is 40 lakhs, you can save up to 4 lakhs in discount!

Another advantage is that the group can share common services needed to complete the transaction such as a home loan, lawyers' fee, and compliances. In these areas the individual home buyer as part of a group, will have more power for negotiation.

Here are some group buying examples:

| Area | Actual Price | Group price | Discount |

| Bombivali, Mumbai | 4000 per sq feet | 3200 sq feet | 20% |

| Krish City Bhiwadi | 13.75 Lakhs | 12.95 Lakhs | 80,000 |

| Paramount Floraville, Noida | 3750 per sq feet | 3525 per sq feet | 6% |

Let's see how group buying works. Essentially, there are two ways.

Buyer initiates the deal

In this case, the potential home buyer posts his or her wish to buy a home in a housing complex. The deal is then listed on the website and potential home buyers are encouraged to form a group if they want to buy a house in the same housing complex or from the same real estate developer. The home buyer can also visit the office of the company and get the required information. Once the group reaches the critical number, the sales team contacts the home buyers, aggregates the demand and submits the bid to the builder. The deal is then negotiated, and finalized. The home buyers get the agreed group discount.

The other way buyer can initiate the deal is to provide his or her requirement to the company. The company looks at its database and find out home buyers with similar requirements. Based on their requirement, the company proposes some of the housing complexes. Once a critical mass accepts the recommendation, the sales team negotiates with the builders and gets the discount as applicable.

Broker Company initiates the deal

In this case, the company posts a potential housing complex that will come up or an existing one. The deal is displayed with discount on offer at the website of the company. The deal also has an expiry date after which buyers cannot form the group. The buyers are encouraged to form a group to avail the discount. Buyers typically register and then show interest in the property posted by the company.

Once the group achieves the critical number, the company submits the bid to the builder. The deal is then negotiated, and finalized. The home buyers get the agreed group discount.

Important Points

While as a home buyer you need to consider all important aspects typical to a home purchase process, you have to consider the following additional points:

The broker company is likely to charge for the services. The charges could be up to 1% of the price of the property. The charges vary with brokers though and hence you should compare and check with companies that provide group buying. You should factor these charges to the total cost of buying your home. Usually charges will only work out to be lesser than the incremental discount you get from group buying. In some cases, the group buying company doesn't charge anything from home buyers but gets its service charge from the developer.

You may have to shell out higher upfront or advance money to a developer. The money asked upfront is usually more than what you pay in case of an individual buy. The amount could be twice as much.

Building critical mass of people to buy houses in a specific location and housing complex takes time. The buyers should like the place; should have the same requirement; should have convenience of communication to their office, and should meet many more requirements of individual buyers. Assimilating all such buyers to form a group will take time and hence home buyers should be ready to wait for the deal to materialize.

Last and most important, read the deal and all its features carefully. In a group buy, most of the buyers think that others have read the terms and conditions and hence do not bother to read it. Do not make such mistakes. Ask if you do not understand some features. This is the most important aspect that you need to provide maximum attention to! When it comes to doing the due diligence, think like an individual not as if you are the only one buying the home and take utmost care to ensure the credibility of builders, papers, and possession.

Manage your home loan in smart ways!

Moving into one's own home is a joy, which is to be

felt not explained. It is utopia what with the poojas, house warming

functions, searching for just the right furniture and fittings, praises

you get for having taken care of the finer parts in construction and

decorating the house and the pride in having acquired a physical symbol

of success.

After the festivities are over, and with the dawn of a new month, a

new realization comes home. For the fortunate few, it is the reminder to

fund your bank account, as the loan EMI is due after a week. For others

the money simply flew out of the bank account.It is time for us to act like the fund manager of a mutual fund or investment fund. Taking informed decisions to manage the asset that we call home and the liability that we call housing loan. By being prudent, you can get high "returns" in the form of saving on interest outflow.

Fund Management When Carrying a Home Loan

As a fund manager of the house, one has to find ways to maximize the benefits of the cash flows. Make a list of all the loans and savings/investments that you have made. Do you find places where the savings/investment is giving lesser returns than the loan rates? This can typically be seen with your endowment insurance plans, your EPF and PPF, the postal deposits, sometimes-even ULIPs. Why should you be invested in something when you are paying higher interest to somebody else? It is better to close all or most of these lesser returns savings/investments and divert the funds to close the home loan.

Care should however be taken to replace an endowment insurance plan with a term plan of higher cover. Your employer and your EPF officer will allow withdrawal of funds from the EPF account for buying and closing the loan of a house. The PPF is not so flexible with letting go of your money. ULIPs and the postal deposits can be closed only after the stipulated 3 years of lock-in.

Ways to repay your debt quickly:

There are ways to come out of the EMIs and make your loan tenure shorter:

1. Partial pre-payment

2. Switching to a lower rate

3. Increasing the EMI

Now let us look at the options in more detail. The best part is that, the options do not in any way add to your existing budget.

Partial Pre-Payment

This is the easiest way to close a housing loan faster. The method is to make use of any one-time income like a bonus, salary arrears, gifts from friends/relatives, any wind fall gains from shares, property sold, deposits closed, tax saving investments maturing, closure of savings that are giving you lesser returns than the housing loan, etc to partially close the housing loan.

The effect is that the one-time payments help to reduce the principal balance in the loan. And when the EMIs continue, they have lesser of the principal to cover. So the same EMIs need a lesser time to close the loan. More earlier and more frequently the partial pre-payments happen the faster the loans close.

Banks generally allow partial pre-payment starting from Rs.10,000/-. There are no charges for partial pre-payment of housing loans.

Switching To a Lower Rate

The interest rates current are in a rising trend. There are times when the interest rates start going down too. Based on the interest rate reset period, different banks will reduce their rates at different times. If the reset interest band of your lender is a wider band, you may be at a higher interest rate for a long time after other banks have started to reduce their rates.

Switching to a lower interest rate will shave off a few years from your housing loan. Care however has to be taken about not jumping too many times or with low interest rate differences. This is because there is a charge for switching loans, i.e. prepayment penalty, which the RBI has been stressing, should be removed from the system. While some banks have already done away with it, some still charge if you do not pay from your own sources. However, it could just be a matter of time till it is totally removed from the system easing the cost burden for the loan borrower further!

Do remember that property verification and other legal paperwork will have to be done afresh in the case of a loan transfer. Also, for a loan transfer to be effective you should have a clear track of having cleared all the EMIs on time, every time.

Increasing the EMI

This is another option to close the loan faster. If you can spare a portion of an increment to increase the EMI, considerable saving could be made. For example a Rs.30,00,000/- loan for 20 years will need an EMI of Rs.28,950/-. If you can spare an additional Rs.2,300/- per month, the loan can be closed in 15 years itself.

The EMI can also be increased by making use of money that was going into an endowment insurance plan or a recurring deposit in a post office.

Increasing the EMI can be done at any point during the tenure of the loan. There are generally no charges for increasing the EMI.

Summary

Only after closing the home loan does one really become the owner of the house. Closing the loan as soon as possible not only relieves the mental strain of carrying a debt but also releases more money into the family budget.

Debt investments: A safer bet now?

In uncertain times everyone takes comfort with their

best friends. Similar is the case with the investor community. Whenever

market volatility increases, inflation raises its head, interest rates

are rising and there is fear of economic down turn, focus of investors

shift from capital appreciation to capital preservation. This is the

time investors remember the old and trusted buddy "Debt Investment",

whom they normally forget in good times. In this article we will try to

understand why this instrument acts as a savior and find out the

reason why it takes the back seat when the investor community is in a

positive mood. We will also try to figure out when the right time to

invest in debt instruments is and what are the options available with

us.

Debt Instrument

A debt instrument is an asset that pays fixed returns over time. It has a fixed maturity period after that the investors can liquidate the asset and gets the principal with the remaining interest dues.

Debts are low risk, low return assets. The liquidity is low to medium.

There are many debt types available to investors to choose from.

a. Fixed Deposits

b. Debt Mutual Funds

c. Bonds and Debentures

d. Government managed saving schemes (NSC, KVP, PPF)

Debt Instrument — Savior in the time of market uncertainty

Whenever there is doubt regarding the economic growth, inflation is high, and interest rate is rising due to monetary tightening, equity valuation goes down as the expected returns from equity investment goes up in a increasing interest rate scenario and return from debt instruments becomes lucrative. As the interest rate is rising, so is the return from the debt instrument. Due to risk aversion investors with a low risk appetite prefer to invest in debt instruments. High risk appetite investors also get into capital preservation mode and reallocate funds towards debt instruments.

The best time to park your money in a debt instrument is at the peak of the interest rate cycle. We all know inflation is increasing day by day and RBI is trying to tame it by monetary tightening. The interest rates have been going up slowly since the last one year as the RBI is tightening the monetary policy. We have seen that RBI has increased interest rates 11 times in last 2 years.

There is also uncertainty about RBI's next move when they meet in this month (September, 2011). It's expected that RBI will increase rates further as till now it has not been able to contain inflation. Based on this assumption we will be somewhere near the peak interest rate scenario around November. So investors should start planning for investment as the risk reward ratio is going to be in favor of investors in another two months.

Choices available for investors

Despite low risk low return nature of debt investment, debts within their own set vary in risk and return. Government securities and bank deposits are almost risk free (let's ignore inflation and interest rate risk) while corporate debts are riskier. Let's take a look at the choices available to investors.

For investors with low risk appetite and long term investment horizon

As per new DTC which is expected to be implemented from April 2012, PPF investments will continue to be governed by EEE (Exempt, Exempt, Exempt) and not EET (Exempt, Exempt, Taxable) meaning investment, accumulation and withdrawal - all three related to this investment will be tax exempt. So investment in PPF is recommended if DTC implements this rule from 2012. Investment in PPF also acts as a tax saving instrument which adds to the overall return on investment. Government securities and schemes are other options for risk-averse investors.

For investors with moderate risk appetite and short term investment horizon

Investment in Debt Funds and FD is a good option for investors with short to medium term investment horizon. Debt funds invest in various types of debt securities and are professionally managed. Most of the debt funds are highly liquid so money can be parked in them for a short term. Once the economic condition improves and interest rate eases, this money can be reallocated to equity portfolio. If you as an investor simply want to sit and enjoy life till normalcy in market returns then medium term FD can be a very good option for you as the return on them is attractive too.

A note on Direct Tax Code (DTC)

The direct tax code is expected to take out various debt instruments available to investors for tax saving purpose. Investment in Government managed saving schemes (NSC etc.) and infrastructure bonds for tax saving purpose are a strict no for the time being as upcoming DTC proposes to remove them from the categories of exempted income. Investors should wait for the clarity in DTC before they invest in them for tax saving purposes.

How your loan repayment works!

To meet some of your goals like buying a car or

building a home might require additional financial help in the form of a

loan from a bank. In the current scenario of rising interest rates it

is vital that you understand important elements in the loan taking

process, helping you make an informed decision when it comes to

balancing your monthly budget and your loan repayment.

What is an EMI?An equated monthly installment (EMI) is the amount of money that is paid back to the lender on a monthly basis. It is essentially made up of two parts, the principal amount and the interest on the principal amount divided across each month in the loan tenure. The EMI is always paid up to the bank or lender on a fixed date each month until the total amount due is paid up during the tenure.

Now, you might assume that the equal parts of the principal and interest is repaid to the financial institution every month, however this not the case. During the initial years the interest component repaid is higher and during the latter years of repayment the principal component is higher. So, if you think you have paid half of the amount borrowed from the bank in 5 years in a 10 year loan tenure that would not be the case. You would probably have reduced the total interest component due considerably and would have only repaid the interest component for the most part.

Here is a simple example that explains how the repayment of your EMI reduces your loan amount during the repayment period leading up to the end of the loan tenure.

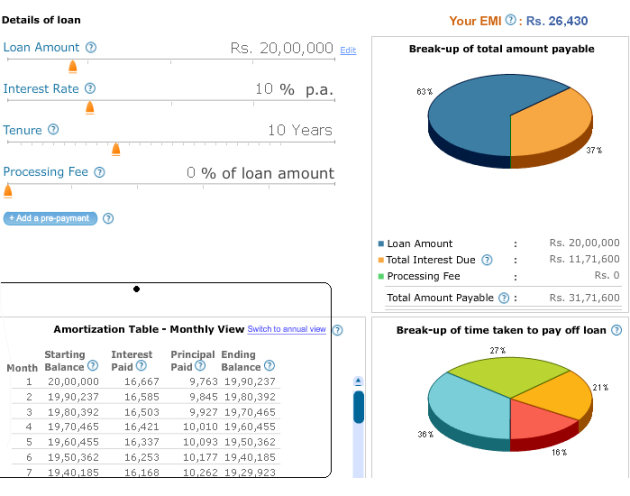

banakbazaargraph

banakbazaargraphHere the loan amount is 20L, which is lent at an interest rate of say 10% with loan tenure of 10 years.

The monthly EMI is calculated at the annualized rate of 10% and amounts to Rs. 26,430 per month.

You will notice that the interest repaid decreases with each passing month and the principal repaid increases with each passing month. In the case of large loan amounts with long tenures, the interest component will be the greater portion of the EMI, which will reduce leading up to the end of the loan tenure, while the reverse is true for the principal component.

Remember to request your bank for an amortization table, which will indicate at any point in time, what exactly your outstanding loan amount is!

EMI and your income

Did you ever wonder why your EMI is generally restricted to 30% or 40% of your monthly income? Here is why. Salary details, qualifications, employer/business, years of experience, growth prospects, alternate employment prospects and sources of other income, if any, are all aspects that determine the amount of loan you are eligible for.

Generally, the repayment schedule is worked out in a manner that allows only around 40-50% of your monthly take home income to be repaid as EMI. It is thus restricted keeping the following factors in mind:

- Around 10% of your income is spent on other loans, if you have any or if you avail one in the future.

- Around 20- 25% of your income could be deducted by way of statutory deductions and for investment purposes.

- Around 20-25% of your income is generally spent to meet your monthly expenses.

This leaves back around 40-50%, which is taken as your repayment capacity for your loan.

For self-employed applicants, profit is the benchmark that determines loan value. The longer the time frame for repaying the loan the lower the EMI and this also means you can opt for a larger loan amount. The loan amount you are eligible for is also dependent on other factors like the company you are employed with, city of residence and your credit history.

A long term loan like a home loan is a debt that is part of your budget every month. If you invest too much into it, there might not be adequate funds to manage a huge list of other expenses that will tend to accumulate with time. For eg. You need to make allowances for future expenses like education expenses for children, emergency funds for a job loss or the loss of one income in a situation where two people have taken a joint loan.

There might be spikes in interest rates. In such a scenario usually banks will increase the loan tenure in order to not put the loan taker in a tight spot by increasing his EMI.

However in such a situation if you have adequate funds in hand or when your income increases with time you could prepay at regular intervals, allowing scope for closing your loan early and reducing your total interest outgo. It is best not to commit to a higher EMI that might cause a strain in your finances; rather it should be the other way around where you can actually control the repayment pattern of your home loan.

Home loans and the festive season

The interest rate for home loans has been going through

the roof for the last couple of quarters. At the same time, CPI

inflation is stubbornly at double digit. As a result, people have

postponed their decision to buy a home or invest in real estate. In such

a scenario, banks are looking for ways to become innovative with their

loan offerings with all the more reason to do so, as we are in the thick

of the festive season!

In this article, we will discuss the discount schemes that are on offer.Dual rate scheme

Dual rate scheme fixes the interest rate for first few years and then changes it to the prevailing interest rate. The prime example of this type of loan offered by banks is ICICI bank. ICICI bank is giving home loans with interest rate fixed for 1st year and 2nd year. After 2nd year, the interest rate charged will follow the prevailing interest rate. The prevailing interest rate will be the base rate of ICICI bank plus the premium. The premium can be anywhere between 0.5% and 1.5% depending on the size of the loan. Here is what ICICI bank is offering:

| ICICI Bank Dual interest rate scheme | Fixed for 12 months | Fixed for 24 months | Fixed for 36 months |

| Less than 25 lakhs | 10.50% | 10.75% | 10.75% |

| Between 25 and 75 lakhs | 11.00% | 11.25% | 11.25% |

| Above 75 lakhs | 11.50% | 11.75% | 11.75% |

This is one of the ways to provide discount on total cost of loan. Punjab National Bank has done away with processing fee completely. This will certainly lower down the cost of home loan by few points.

Concession on home loan

State Bank of India, Dena Bank, and Corporation bank are giving discount of few basis points for home loan till the end of this year. SBI and Dena bank have offered discount of 25bps while corporation bank has offered up to 100 bps discount. Corporation bank has also waived off 60% of the processing fee.

Progressive monthly instalment scheme

Few banks are providing loans on progressive monthly instalment scheme where the borrower's liability or EMI is based on increase in salary. Hence the EMI will be lower in first few years and will be regular after the period. Corporation bank offers this scheme. This scheme is especially good for young people who expect their salaries to rise in future.

Fixed rate home loan scheme for few initial years

This is another addition to the schemes offered by banks to home loan borrowers. HDFC bank is offering two variants of the scheme. Home loan borrowers can choose either 3 years fixed or 5 years fixed home loan scheme. The offers are as follows:

| HDFC Bank fixed rate for few years | Fixed for 3 years | Fixed for 5 years |

| Less than 30 lakhs | 10.75% | 11.25% |

| Between 30 and 75 lakhs | 11.25% | 11.50% |

| Above 75 lakhs | 11.75% | 11.75% |

Fixed rate home loan scheme is offered by Axis bank. This fixed rate will remain fixed for the complete tenure of the loan. This scheme is known as "Nischint". There is no change in EMI and no surprises. The EMI will be set once and for all. The interest rate is 11.75%.

Points to note

Due to the rising interest rate scenario, product innovations abound in the market, however borrowers should take care to weigh the pros and cons of the scheme. Finally, borrowers should compare the rates and overall charges from different banks to arrive at the effective cost of the loan and then make their decision.

The general perception in the market is that interest rates are near its peak; it might go up once or twice and then begin a downward trend. Keeping this aspect it mind, explore the home loan options available with an open mind, especially if you have bagged a good home deal, which could become a lost opportunity, if you failed to latch on to it.

On the other hand, borrowers should do their due diligence and research loan schemes where the interest rate or EMI in the initial years is low. Borrowers should arrive at a rough estimate of the possible interest rates after the initial years. They should check the base rate, premium over base rate, and historic data on past loan schemes to arrive at this possible interest rate as part of their decision making process.

Stock Investing – Short Term Strategies

There was a research conducted in United States on the

average number of days investors hold the stock. The number was 187

(about 6 months) in 1991-1996 period. The median was worse with just 90

days. With internet boom era and overpriced IPOs in 2000s, this came

down to about 3 months. There is no data available for Indian market but

looking at the volatility of our stock market, the numbers will be very

close or even less.

This tells us there are mostly short term traders in the market. Is

there anything wrong with short term trading? Absolutely not, but

investors should know the rules of the game before they trade short

term. Apart from knowing the rules, investors should also understand

that short term trading mostly relies on luck and on study, which at

best can be termed speculative.In the current volatile market scenario, you could be tempted to try your luck in some short term investment strategies to make the best out of a bad situation. Here is an understanding of some short term trading strategies usually followed by short term traders. Knowing these strategies will make you aware of your own actions. However, do proceed with caution.

Day-trade in stocks

In this trading style, traders buy and sell the stocks on the same day or in a very short period of time. The traders take advantage of daily market volatility to profit. They buy when the stock prices go down hoping the prices to appreciate in the day. They square-off by the end of the day. This can result in profit or loss depending on whether the price they sold at was higher or lower than their buy price. This is a very popular way to trade. The popularity stems from the fact that this looks exciting. Even if traders lose money, the loss doesn't seem big as daily variation is not very volatile.

Day-trading, however, is the most popular way to lose money. Majority of day-traders either lose money or do not make better than a long term investor. Investors look at daily loss and assume that this is not a big loss but accumulate the losses for the year and they can see the big picture.

Take an example. If I have 1 lakh and I gamble, I will be happy to earn Rs 2000 from my gamble. However, I will not be too worried if I lose Rs 2000. This psychology works against traders. The happiness to get marginal profit is more than the sorrow of suffering a marginal loss. Take another example. A buyer goes to a showroom and to buy a car worth 3 lakh. At the last moment, he comes to know that the seller is giving Rs 6000 coupon free to be spent in lifestyle. At the same time, another buyer goes to another shop and buys the car at 2 lakh and 94000 rupees. Both come out of the shop. Whom do you think will have bigger smile?

Risk mitigation

Investors should not put all their money in day-trading. If you are too excited by daily price volatility and want to try your hands in day-trading, put at most 10% of your total investment for this and play with this. Do not gamble more.

Trading on margin

In margin trading, the investor spends some part from his or her pocket and borrows the rest from the broker at an interest. In this context, investors have to understand the concept of initial and maintenance margin. Initial margin is the % of total investment that investors have to put. When the prices go down, your contribution in terms of percentage will go down. After it goes below a certain percentage, the broker will ask you to put more money to take it to the initial margin. This "certain percentage" is called maintenance margin.

Take an example. Let's say an investor, Rakesh buys 100 stock of Airtel at Rs 400 a share. The initial margin is 25% and maintenance margin is 10%. This means Rakesh has to put 10,000 (25% of total investment of 40,000). The rest 30,000 is borrowed by broker. Suppose the prices start going down and goes to Rs 330 a share. In this case, the total value is 330*100 = Rs 33,000. Let's calculate what the contribution by investor at this point is. The investor contribution is (33000-30000)/33000. This is less than 10%. Hence investor will get a call to put more money so that his or her contribution is 25% of Rs 33000 which is Rs 8250. Since his amount is 3000, he will have to deposit another 5250.

This is high risk high return strategy. The advantage is that if the prices go up, you earn all the profit minus the interest you pay to the broker on his contribution. However, the loss is equally yours because the broker will anyway charge the interest. This is a double whammy.

Risk Mitigation

The only risk mitigation strategy is that the investors should never put more money when margin call is given by the broker. The investor, instead, should ask the broker to square off the position with whatever loss has happened. Avoid the temptation to put more money after the margin call.

Selling short

In this short term strategy, investors borrow and sell the shares and later they have to buy this from open market and give it back to the lender. The idea is to benefit from decreasing prices. Investors short-sell stocks because they assume that prices will go down and when it goes down they buy it cheaper and give it back. The difference is the profit to investors.

Take an example. An investor Rakesh expects the price of Airtel with current market price @400 to go down. Since he has no stocks, he borrows 100 Airtel stocks from the market and sells it immediately earning 40,000. After sometime, as he expected, the Airtel price went down to 350. He buys 100 stocks back at 35,000 and gives it back. He earns Rs 5000 from this transaction. We are ignoring transaction costs and other charges for the sake of simplicity.

Short term is tempting to investors. Short term trading offers excitement, action, and instant gratification. Compared to this, long term is boring, tedious, and requires extreme patience. However, there is no way to build wealth but by using long term strategies. This is true for most of the investors. There are short term investors who have done tremendously well but they are few and far between. Hence investors should put their major portion of investment corpus for long term wealth building assets and segregate a minor portion for short term speculation.

Currency fluctuation and your investment!

Rupee falls at Rs 48 a dollar. Do we even care for such

news? We leave it to NRIs to worry about the exchange rate. For

domestic investors, does rupee fluctuation hardly make any difference?

Most investors do not read between the lines regarding how rupee

fluctuation impacts their investments. Moreover, the exchange rate

phenomenon seems esoteric for most of the common investors. In this

article we will discuss some aspects of rupee fluctuation on our

investment.

Currency fluctuationThere are mainly two ways by which currency rates are managed. Firstly, countries fix their currency against dollar. Hence the exchange rate doesn't change. Government takes action to manage any fluctuation that may happen. Secondly, countries leave it to the market to decide their exchange rate. In such a system, countries follow policy of non-interference.

India doesn't have a fixed value of rupee against dollar but it also doesn't keep its currency completely floating against dollar. We have a system where the central bank allows rupee to fluctuate within a specified range.

Usually, rupee appreciation is taken as economy gaining strength while depreciation is taken as Indian economy losing strength.

How it impacts investors

Let's look at how rupee fluctuation impacts investors' decisions. Let's look at appreciation first.

Rupee appreciation -

Rupee appreciation is considered bad for companies where major part of their revenue comes from export. Appreciation of rupee makes products more expensive for export. When the products become expensive, importing nations either reduce the import or look out for other nations that can produce the same product at cheaper prices. Hence, any appreciation in rupee is often accompanied with clamour by export companies to devalue the currency.

Rupee appreciation is good for companies that depend on import from other countries. For example, oil companies, Parma, Engineering, and medical device companies will be fine with rupee appreciation. The machinery, oil, and engine used in such industries will be cheaper to buy. Investors can consider investing in such companies when rupees appreciate.

Let's take an example. Suppose the rupee dollar exchange rate is 50 (i.e. Rs 50 - $1). A company in export sector earns a profit margin of 15% from export. If the rupee appreciates and the new exchange rate is Rs 40 = $1. In this case, the company has lost 20% of the income.

This impacts investors in sectors that depend on export for their income. The typical examples are software industry and textile. Their dependence on export is heavy. Any rupee appreciation will hit software and textile industries hard. We have seen what happened in 2008 when America went into recession, dollar lost value and rupee appreciated against dollar. There were lay-offs, increased hours, flat revenues, and reducing profit. Investors in export oriented sector will be hit by any appreciation in rupee.

Rupee depreciation -

Rupee depreciation is when it loses value against dollar. For a nation like India where import is more than export, rupee depreciation makes things worse because imports get expensive. This increases the deficit. Rupee depreciation is not a good signal except for export driven companies.

For Indian economy, which depends on oil import, any fall in rupee will impact its oil bill. This will increased inflation because of increased oil bill. Increased inflation eats into the returns of investors. Moreover, a high inflation reduces the economic activity and consumption.

Software companies, textile companies, and many other export driven sectors such as tourism are the ones where investors can think of investing. Their export becomes cheaper and hence they can sell more to the overseas clients. These companies will do well.

Important points to keep in mind

Since the global crisis is yet to stabilize, there will be extreme fluctuation of currency or rupee. Greek crisis, Eurozone, America's growth, and many other factors will impact the currency rate. The most recent example is rupee's fall from Rs 44 a dollar to Rs 48 a dollar within a month. This happened because Euro went down against dollar as a result of Greek crisis. As a consequence dollar improved not only against euro but against many currencies. Investors are requested to trade based on currency fluctuation only when they have some expertise in this.

There will be times when rupee fluctuation may not impact individual companies or sectors because of other factors present. For example, if rupee depreciates against dollar further, there is not much chance that software industry will improve its income as they did in the past. They have become quite matured and going from here to the next level will require different ways to develop software.

Finally, the rupee dollar exchange rate will remain volatile till the crisis persists. Hence investors should practice caution when investing in exchange rate sensitive sectors.

Understanding your true net worth!

An accurate understanding of one's financial well being

is of utmost importance at every stage of life. So, whether you are a

student, fresher into the job market or a veteran - assessment of

personal financial health is important in order to make good financial

decisions. For example, even if are purchasing a car, purchasing a home,

taking a student loan, liquidating an investment or making a risky

investment - all these decisions can be made only if you know your

financial status well.

An individual's financial health is computed by means of his personal

net worth. In simple terms, personal net worth is the net asset value

of an individual. Personal net worth is calculated as follows:[Total Assets] less [Total Liabilities]

One must assess his / her net personal worth on a regular basis. This is because corrective measures can be taken in time if the net personal worth starts declining. It is much easier to recover at early stages than once you find yourself in deep financial crisis. Your net personal worth will also give you an idea about how financial institutions perceive you as a borrower. For example, Deepak, an IT consultant with a software company wants to purchase a car. He has set his eyes on the Toyota Corolla. The car dealer informs him that the on road price of the car will come to Rs.11.25 L. If he takes a car loan, he will have to pay a monthly EMI of Rs. 15,000 towards repayment of the car loan and pay an amount of Rs. 1.0 L as down payment. Deepak's monthly salary is Rs.0.9L and the EMI as well as the down payment seems easily affordable. However, Deepak should assess whether he can afford to buy this car at present by considering all his liabilities and assets. His personal net worth should give him a fair idea of his current financial status and whether he can afford to buy the car.

Computation of Deepak's personal net worth

| Assets | Rupees in '000 |

| Current Market Value of his apartment | 5000 |

| Market Value of his TVS Scooty (two - wheeler) | 10 |

| Value of Fixed Deposits | 500 |

| Market Value of shares held by him | 200 |

| Market Value of Mutual Funds owned by him | 500 |

| Market Value of Jewellery | 300 |

| Value of NSCs | 5 |

| Amount in PPF | 10 |

| Cash in bank and in hand | 100 |

| Total Assets (A) | 6625 |

| Liabilities | |

| Outstanding home loan | 4500 |

| Outstanding loan on TVS Scooty | 2 |

| Outstanding student loan | 200 |

| Outstanding credit card bills | 50 |

| Total Liabilities (B) | 4752 |

| Personal Net worth (A-B) | 1873 |

Note that knowledge of current personal net worth is essential to make financial decisions. It is important to reevaluate personal net worth while making any important financial decision as the value of assets and liabilities is likely to change. Also, net worth should not be considered in isolation. It is a good idea to consider factors like current and future income levels, future liabilities etc. For example, if Deepak has to bear the expenses of his sister's wedding which costs him approximately Rs. 9 L and he has to sell off some of his investment to meet the wedding expenses, his personal net worth will look different. Further, if the market value of assets declines, his personal net worth will also take a hit. Let us take a look:

Deepak's Personal Net worth if he has to bear his sister's wedding expenses and if the economy takes a down turn:

| Assets | Rupees in '000 |

| Current Market Value of his apartment | 3000 |

| Market Value of his TVS Scooty (two - wheeler) | 10 |

| Value of Fixed Deposits | 0 |

| Market Value of shares held by him | 100 |

| Market Value of Mutual Funds owned by him | 200 |

| Market Value of Jewellery | 100 |

| Value of NSCs | 5 |

| Amount in PPF | 10 |

| Cash in bank and in hand | 0 |

| Total Assets (A) | 3425 |

| Liabilities | |

| Outstanding home loan | 4500 |

| Outstanding loan on TVS Scooty | 2 |

| Outstanding student loan | 200 |

| Outstanding credit card bills | 50 |

| Total Liabilities (B) | 4752 |

| Personal Net worth (A-B) | (1327) |

Understanding how HRA works!

The end of another financial year is drawing close and

is a couple of months away. The words "income tax" start ringing a

frantic bell towards the end of every financial year, and many questions

arise. Please do note that it is best to be prepared in the beginning

rather than the end of a financial year!

There are many tax components you need to be clear about and also

figure out how to plan your investments to gain maximum returns as well

as maximum tax benefits. One such tax component is the tax benefit you

can claim from your house rent allowance. This article helps you

understand how this works!HRA (house rent allowance) is provided to salaried people under Section 10 (13A) of Income Tax Act, 1961, in accordance with rule 2A of Income Tax Rules. Self employed professionals are eligible for tax deductions under section 80GG of Income Tax Act, 1961.

Dependent factors

When you are calculating HRA for tax exemption you take into consideration four aspects which includes salary, HRA received, the actual rent paid and where you reside, i.e. if it is a metro or non-metro. If these aspects remain constant through the year, then tax exemption is calculated as a whole annually, if this is subject to change, as in a rent hike or shift in residence etc. then it is calculated on a monthly basis.

The place of residence is significant in HRA calculation as for a metro the tax exemption for HRA is 50% of the basic salary while for non-metros it is 40% of the basic salary.

On paying rent

It is not essential that you should pay rent only to a landlord to avail your HRA benefits. You can pay rent to your parents to claim tax benefits. However, they need to account for the same under `Income from house/property' and will be entitled to pay tax for the same.

Remember you cannot try the same with your spouse, as it is not permissible under income tax law, as you are expected to reside together for all practical purposes.

You need to submit proof of rent paid through rent receipts, for which only two need to be submitted, one for the beginning of the year and one towards the end of the financial year. It should have a one rupee revenue stamp affixed with the signature of the person who has received the rent, along with other details such as the rented residence address, rent paid, name of the person who rents it etc.

How is HRA calculated

To figure out how much HRA exemption you are eligible for, consider these three values which includes a. The actual rent allowance the employer provides you as part of your salary, b. the actual rent you pay for your house from which 10% of your basic pay is deducted, c. 50% of your basic salary when you reside in a metro or 40% if you reside in a non-metro.

The least value of these three values is allowed as tax exemption on your HRA. You can discuss restructuring your pay structure with your employer in order to avail the most of your HRA tax benefit.

Here is a sample illustration for your understanding:

Sheetal earns a basic salary of Rs. 40,000 per month and rents an apartment in Delhi for Rs. 20,000 per month (hence eligible for a 50% of the basic pay for HRA exemption). The actual HRA she receives is Rs. 25,000.

These values are considered to find out her HRA tax exemption:

a. Actual HRA received, i.e. Rs. 25,000,

b. 50% of the basic salary, i.e. Rs. 20,000, and

c. Excess of rent paid over 10% of salary, i.e. Rs. 20,000 — Ra 4,000 = Rs. 16,000

The value considered for her actual HRA exemption will be the least value of the above figures. Hence, the net taxable HRA for Sheetal will be Rs. 25,000 — 16,000 (available HRA deduction) = Rs. 9,000.

Availing tax benefits on your home loan and HRA

As long as you are paying rent for an accommodation, you can claim tax benefits on the HRA component of your salary, while also availing tax benefits on your home loan. This could be the case if your own home is rented out or you work from another city etc. However, you need to account for any rental income you receive from the property you own.

Are You Looking To Buy A Home?

The year 2011 witnessed a high interest rate scenario,

shrinking profit margins and soaring input costs for property developers

in India. The economic slowdown added problems for property dealers, as

the number of customers dwindled in 2011. Most of the developers had to

put their expansion plans on hold, and their existing projects also

faced a setback due to slow sales, resulting in a piling inventory. In

2012 the realty market is expected to consolidate, and most of the

developers are likely to focus on generating liquidity for better cash

flow by selling their existing projects at a lower rate to tackle the

stagnation in sales. The first priority for every developer would be to

complete their existing projects to cut the capital involved for

projects in progress. This situation would wash out players who just

exist in a market to create competition against the genuine developers.

Now the question is what step a home buyer should take under such market conditions?A person would be interested to purchase a property to either reside in it or to invest or both. In this article, we will focus on the various issues related to purchasing property for residential purpose. The current market condition has categorized residential property buyers into two categories, which are:

- Existing Buyers: Those who have already put their money for buying a home but the possession is not received.

- New Buyers: Those who are contemplating buying a home.

The state of existing buyers:

Due to the economic slowdown, there are lots of property buyers who have already paid for their homes, but the developers have delayed proving them possession. Due to lack of funds and rising input costs, developers have either stopped the project or restructured the plan by adding more homes under a project to bring liquidity and cost averaging. If the buyer has included the penalty clause in the purchase agreement for delay in possession, then they can claim it immediately from the developers. The delay penalty safeguards a buyer by binding a developer to pay interest on the amount invested, if the possession is delayed for some reason.

However, it must be noted that the delay penalty may not depend on the prevailing interest rate in the market. This means that the existing customers who have not received the possession, have to pay home loan EMIs at current interest rate, which is at peak, whereas the delay penalties they obtain from the developers are at a lower interest rate as it has been agreed upon at an older interest rate when loans were cheaper. Existing buyers could be quite disappointed in such a scenario as they are losing possession as well as money!

What the new buyers can expect:

The new buyers have all their options open before they decide to buy a home. Though the market may not seem very attractive for an existing buyer for a new buyer it is a different story. This is a very good time to buy a home. Here is why:

- The interest rate for home loans is at peak, and RBI has recently hinted a fall in coming days; so new buyers are likely to pay their EMIs in a falling interest rate scenario! Hence, the interest burden will be reduced significantly in such a situation.

- Many buyers anticipate an interest rate drop and postpone their purchase decision, but it should be noted that, at present the developers are offering very attractive discounts as they need liquidity and are left with a huge inventory. If the interest rate falls, then this offer would not be available as the liquidity position would improve in the market.

- As there is considerably less investor rush in the current market due to high borrowing cost, choices are aplenty!The buyer can customize his purchase of the home for its location, size, price and other important aspects due to sluggish market conditions.

- Also, new buyers have the option of purchasing both from a developer and an existing buyer in the current market situation and better bargains can be struck.

Points to remember for the potential buyers

The new buyer should take a cautious approach while finalizing a home purchase bearing the following aspects in mind.

- If the new buyer decides to buy a home in an ongoing project, then chances of delay in possession is always possibility so due diligence is very necessary.

- To rule out the loss due to possession delay, the delay penalty must be incorporated in the agreement with the developer. Though the interest rate is expected to fall in coming days, the penalty should be based on a floating basis because in case the interest rate increases due to any unexpected event, then the delay penalty would also increase and protect the buyer from loss.

Let's understand this with the help of an example:

Suppose a person "B" has decided to buy a home and raised a home loan at 10% p.a. The developer "S" promises to handover the possession of the house within two years or else agrees to pay a penalty at 1% lesser then the bank's interest rate, i.e. penalty at 9%. B has two options, either to fix the penalty interest at 9% or keep it floating at 1 % lesser than the bank's interest rate. If S defaults in giving possession after two years and delays for one extra year, then the following situations would arise:

Case I: Penalty fixed at some rate say at 9% p.a.

Suppose if the bank's interest rate falls to 8% p.a., then S would pay penalty at 9% for a one year delay. Hence B would get the benefit of extra penalty over bank's interest rate. However, if the bank's interest increases to 12%, then also S would pay penalty at 9%, hence B would lose more against the bank's interest rate. Hence, buyer has chances to gain as well as incurs the risk of loss in this situation.

Case II: Floating Penalty

Since S agreed to pay a penalty at a floating rate system it does not matter whether bank's interest falls or increases because the penalty rate would be 1 % lesser in every scenario. Hence buyer would hedge his position against increase or decrease in interest rate.

- If the buyer decides to buy a house from an existing buyer who owns a ready flat, then it is very important to check the encumbrances thoroughly. The other basic aspects such as electricity bill, telephone bill, and building society bill along with developers' agreement should be checked properly before finalizing the deal.

- The new buyer should select a floating rate system while applying for a loan and also negotiate with banks to waive the prepayment penalty charges for future. According to the RBI mandate prepayment penalty is expected to be done away with but do ensure if this is indeed the case as some banks might still be imposing it. Prepayment can be done either as a one-time payment or switching the loan to another bank with a lesser interest rate or even a partial prepayments over a period of time. The prepayment decision should be taken based on the remaining loan amount, term and the ease with which the funds can be arranged.

- Many developers are compromising with the quality of construction materials due to high input costs, so the new buyers must check to verify such aspects before buying the house.

- In the recent past, lots of hue and cry was made by developers and buyers in Delhi NCR due to court orders to stop construction on account of multiple land disputes. The new buyers must verify all the legal aspects before finalizing the deal. The contract with a developer should be verified properly to avoid fraudulent intentions. The buyer should always insist on the developers including the time binding clause to avoid excess delay in the project. If the project is delayed much beyond the promised time, then the buyer should not hesitate to knock the doors of the court. Recently, lots of cases have come into the picture where courts have provided relief to the buyers by ordering complete refund along with penalty against the developer.

Keeping in mind the various points discussed above in this article, an existing buyer should strive to make an early repayment of the loan, as many banks have waived the prepayment penalty. If the flat is under construction stages, then they can also opt for exiting the deal by reselling or canceling the agreement if possible to avoid loss due to uncertainty of project completion. The new buyer has a good opportunity to buy a house at a discounted price and desired location. Proper due diligence and price negotiation are key aspects for the new buyer.

Infra bonds and other alternatives

Government of India has outlined a plan to spend $1

trillion in next 10 years on infrastructure development. This

development is needed because infrastructure needs to support and

sustain the projected growth rate of Indian economy for next few

decades. To fund this initiative, the Government is trying to tap the

various sources at its disposal. Infrastructure bond is just one source

where Government has given tax breaks for up to Rs 20,000 for

individuals. This is to attract retail investment.

Infrastructure bond vis-à-vis other debt instrumentsInfrastructure bond is widely welcomed by salaried individuals who have been demanding to increase the tax break from 1 lakh. It has given them another avenue to invest for tax saving purpose. Let's take a look at other investments that are available and provide a fixed income.

Debt oriented mutual funds

The other debt instruments available for investment are debt oriented mutual funds. These funds allocate major part of the fund in Government securities, corporate bonds and debentures, and sometimes in fixed deposit. They can be a good alternative. However, even though they are debt oriented funds, a small part (up to 30%) goes towards equity. Hence investors do see fluctuation in returns. The average returns from debt oriented funds over a period of time can be about 12% depending upon the market condition and proportion of fund invested in equity.

Bank fixed deposit

The other option is banks where the rates of interest have gone up. Few banks are giving good returns on fixed deposits. For example, bank of Baroda is giving 10% returns on fixed deposit. This is certainly better returns in absolute term. The post-tax returns will be about 7%. There are other banks which are offering similar rates on fixed deposits.

Corporate fixed deposit

Then there are fixed deposits offered by blue chip companies. These are highly rated debt instruments. For example, Mahindra Finance or Tata Motors deposits are two prominent offers that offer 10.25% returns. Mahindra fixed deposit scheme is rated FAAA, the highest rating. The payment is done quarterly. There are other firms which offer even better returns but those firms rated lower. Investors should consider these alternatives too.

Fixed maturity plan

There are mutual funds, also known as, fixed maturity plans (FMP). They are as good as fixed deposits and offer an "expected" return of 9% to 10% . We use "expected" because there is always the risk of corporate default (though it rarely happens).

Hence all the options look better till you consider the tax advantage that the infrastructure fund provides you. Tax advantage is the biggest advantage that infra bonds provide. The interest received on infra bond is taxable though.

Investors' response

Infrastructure bond has seen tremendous response from retail investors for tax saving purpose. The demand goes up before the end of the financial year. Even though it is a big hit among salaried individuals and retail investors, it did not impress big ticket investors in India and abroad much because they are more focused on getting better returns than saving tax.

To encourage response from FII, Government is planning to reduce the lock in period of infra bonds. The lock in period currently is 5 years. In all probability, this may come down to 1 year. The reduced lock in period may be able to bring foreign capital for infrastructure projects which are delayed because of lack of funds.

Ideally, reducing the lock in period should bring more investors, both domestic and multinational. This seems to be a good way to increase participation and transaction. However, the downside of this is that it will increase speculative investment.

Retail investors anyway invest in infra bonds to save taxes and hence there isn't much scope left in retail segment.

Important points to keep in mind